And why it's hurting artists

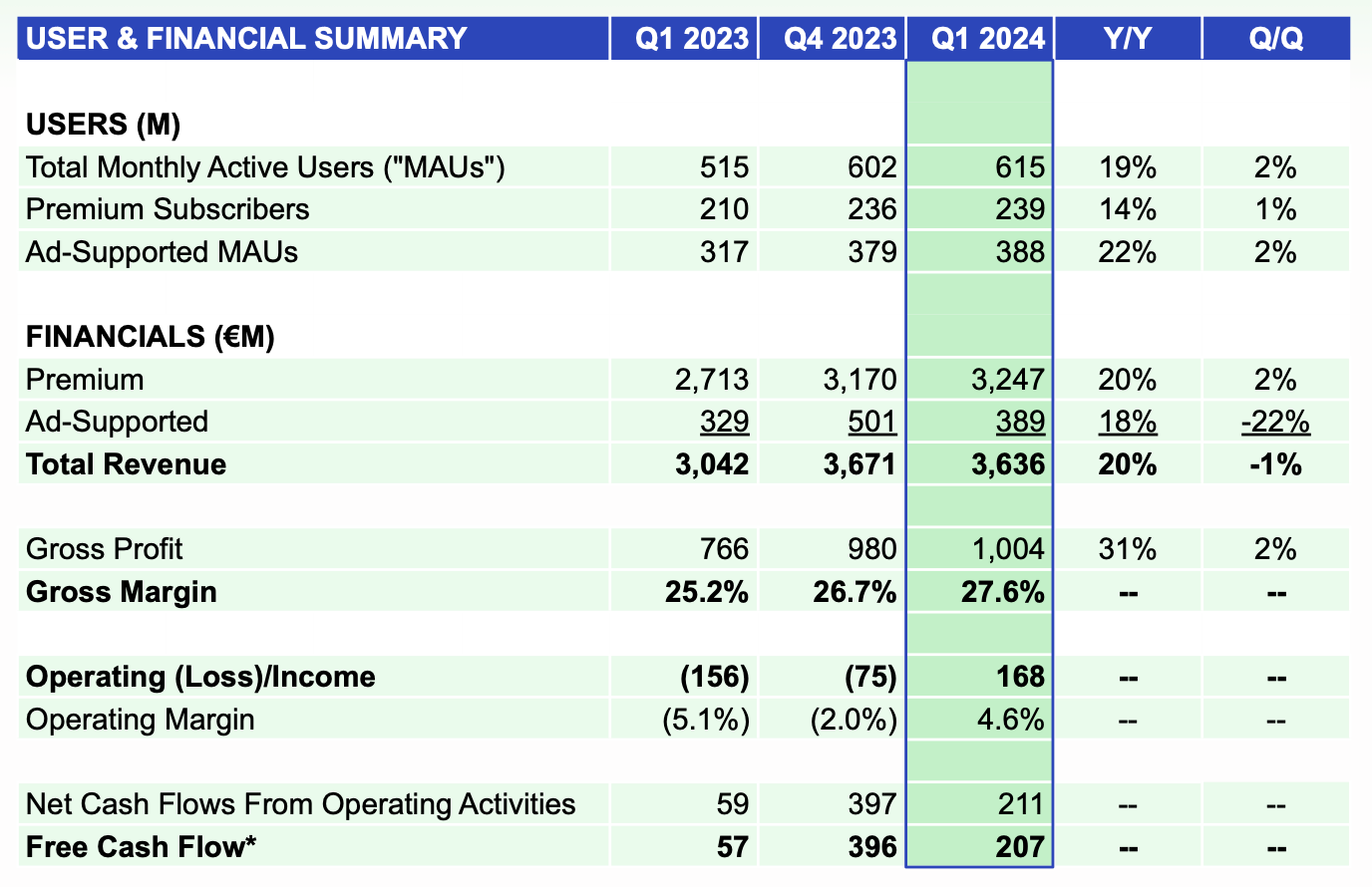

This table from Spotify’s Q1 2024 financial report left me with one big question.

Why can’t Spotify make any money from ads? Look at the numbers. Sixty-three percent of its users generated just under 12 percent of its revenue. Spotify made, on average, $0.35 per ad-supported user each month over the last quarter. It did a little better the previous quarter because of the holiday ad push, but it still only averaged $0.47 per user each month.

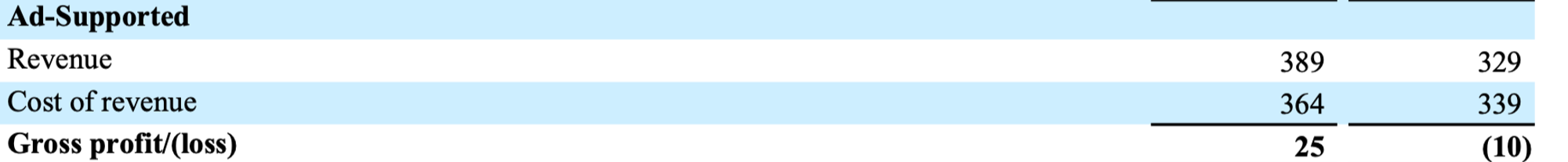

Even worse, the margins on these users are razor thin: 6 percent gross margins, versus 30 percent for paid users. Spotify even lost money on these users the first quarter of last year. Somehow, it paid more in royalties on their streams than it collected in ad revenue, presumably because royalty payments hit some contractually-stipulated floor. (Maybe also out-the-nose podcast deals with British royalty?)

I can think of a few reasons why Spotify is struggling with its ads business.

1. Facebook and Google

Blaming Facebook and Google for problems in the ad market is basically throat-clearing at this point. But it’s true these two companies have sucked up most of the profit to be had in digital advertising. Maybe this is like asking why an entire generation of ad-supported digital media companies went bust over the last couple of years — because no one makes money from traffic except Facebook and Google.

Surely the dominance of search and display ads hurts audio. Try as Spotify may, no one in the audio space can target ads with nearly the accuracy that Big Tech can. But it’s not doing that well within the audio ad space either. The company’s $1.5 billion in 2022 ad revenue pales in comparison to the $14 billion radio ad market. Maybe it’s unfair to compare one company to an entire industry, but on the other hand, Spotify aspires to be the one audio destination to rule them all. It has a long way to go.

To Spotify’s credit, it’s captured a fairly large slice of the digital audio ad market, but it’s only half the size of radio for reasons that are still mysterious to me. Perhaps the most surprising part of Spotify’s report is how well radio is holding up against digital.

Before Spotify can really complain that Big Tech puts a ceiling on its growth, it needs to dominate the audio ad market. For reasons that are also mysterious to me, it’s not doing that.

2. America’s the best

North America accounts for just 19% of Spotify’s monthly active users, behind both the European and Latin American markets. That could be a problem for the company. They don’t break down revenue per user based on region, but other companies do, and it’s clear the North American consumers are the ones you want. At Snapchat, for example, a North American user brings in about $3 per month, a European user just $0.83 per month, and a user elsewhere a mere $0.34.

If you’re in the business of serving ads, you want to be serving the richest and most gluttonous civilization in history. Maybe Spotify is better at monetizing European users than Snapchat is, but I have no reason to believe that. On the bright side, Spotify's revenue per user will grow as the developing world gets richer, so at least the company has big macroeconomic trends in its favor.

3. People put a low economic value on music

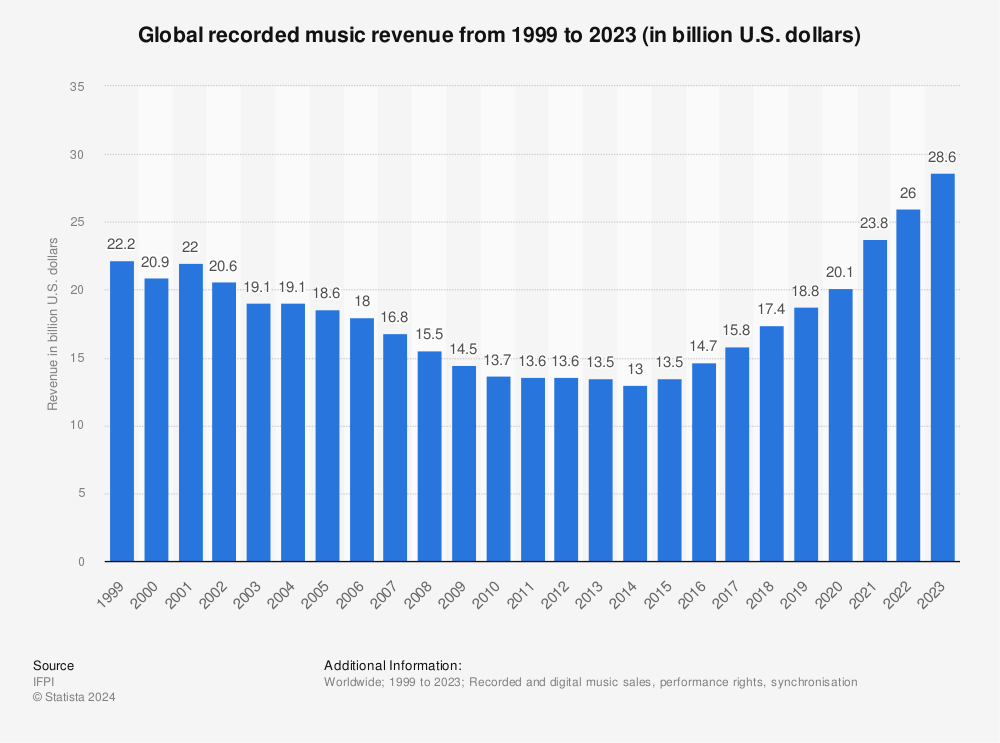

Before I’m too hard on Spotify, let’s look at a graph of the music industry’s revenue over the last 20 years.

If given a choice, most people would rather not pay for music. By the time Spotify came to the US in 2011, piracy had already brought the music industry to its knees. Say what you will about Spotify, but they were the first player in any medium to figure out how to beat piracy.

They did this by 1) creating a better user experience than piracy, and 2) making Spotify’s value proposition ridiculously good for consumers. We don’t marvel enough at how Spotify found a way to save the music industry by offering everything for a low monthly fee. And Spotify’s and Apple Music’s paid subscribers are now the economic lifeblood of the industry. Maybe experimenting with the free tier was just the cost of discovering the paid tier, and everyone in the music industry should just be thankful. Besides, if they won’t pay for music, there might be a low ceiling on the ads they’ll put up with, and nobody wants them to leave the platform altogether. This brings us to…

4. The $5 Rotisserie Approach

Like Costco’s famous $5 rotisserie chicken, Spotify’s ad tier is something it’s willing to sell for no profit, perhaps even a loss, just to get customers in the door. There’s a lot to be said for this approach —Spotify’s free tier is the main pipeline into its paid tier. And it makes good money from paid subscribers.

But come on, Spotify is just leaving too much money on the table. Snapchat, the size of a gnat on the back of Big Tech, can evidently make money from ads. Not caring too much about how to make money from free listeners strategically defensible, but it’s unfair to artists.

Why Spotify is letting artists down, but not for the reasons they typically think

Artists are right to complain about the $0.003 per stream. (Maybe $0.007? Some arbitrarily-small decimal.) But it’s usually framed as a distribution problem — Spotify is hoarding money — when it’s actually a revenue problem. Spotify isn't making the money in the first place! This isn’t letting Spotify off the hook. It should be able make more than a few bucks per ad-supported listener per year! But until it does, those few bucks have to be split across all the tracks the listener streamed over the entire year. Once they listen to a few hundred tracks, we get into fraction-of-a-penny territory.

Spotify is compelling artists to be $5 chickens. For Spotify, basically the entire economic value of a free listener is wrapped up in the possibility that they will covert to the paid tier later on. This is fine if you’re a tech company whose value is based on the expectation of future profits. You can tap into a free listener’s value by selling stock.

Speaking of the stock, it’s more than doubled over the last twelve months, so perhaps the most compelling counterpoint to this entire rant is “Shut up and let Daniel Ek cook.” It would explain why labels don’t seem terribly terribly concerned, since the Big 3 own quite a bit of equity in Spotify. Plus they’re investing a lot in, like, programmatic ad insertion or something, so maybe the money spigot will turn on soon. I’ll believe it when I see it. But artists have to eat today!